As the Number of Stocks in a Person's Portfolio Increases

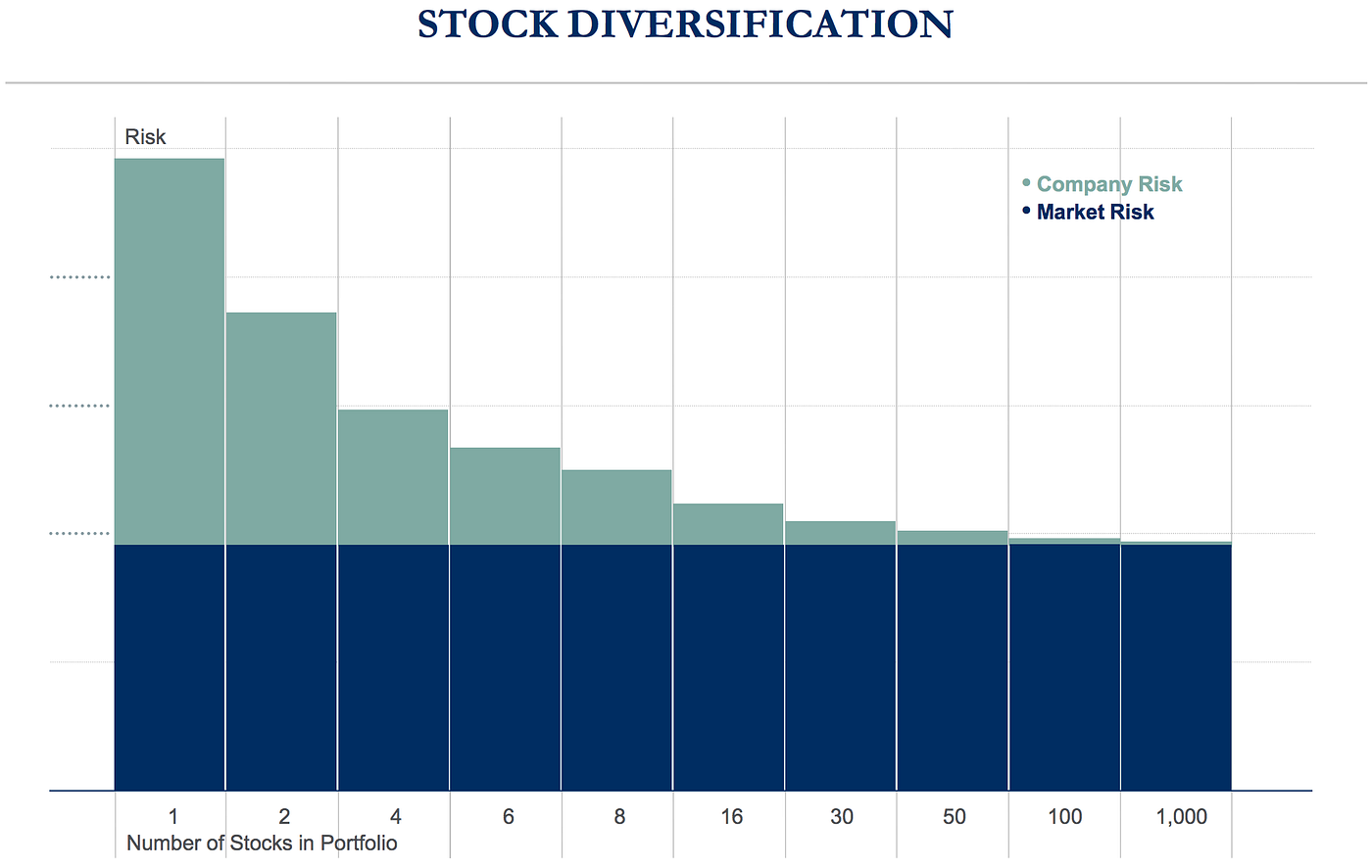

Evans and Archer observed that the risk reduction effect diminishes rapidly as the number of stocks increases. But the standard deviation has units of and therefore the average standard deviation does as well.

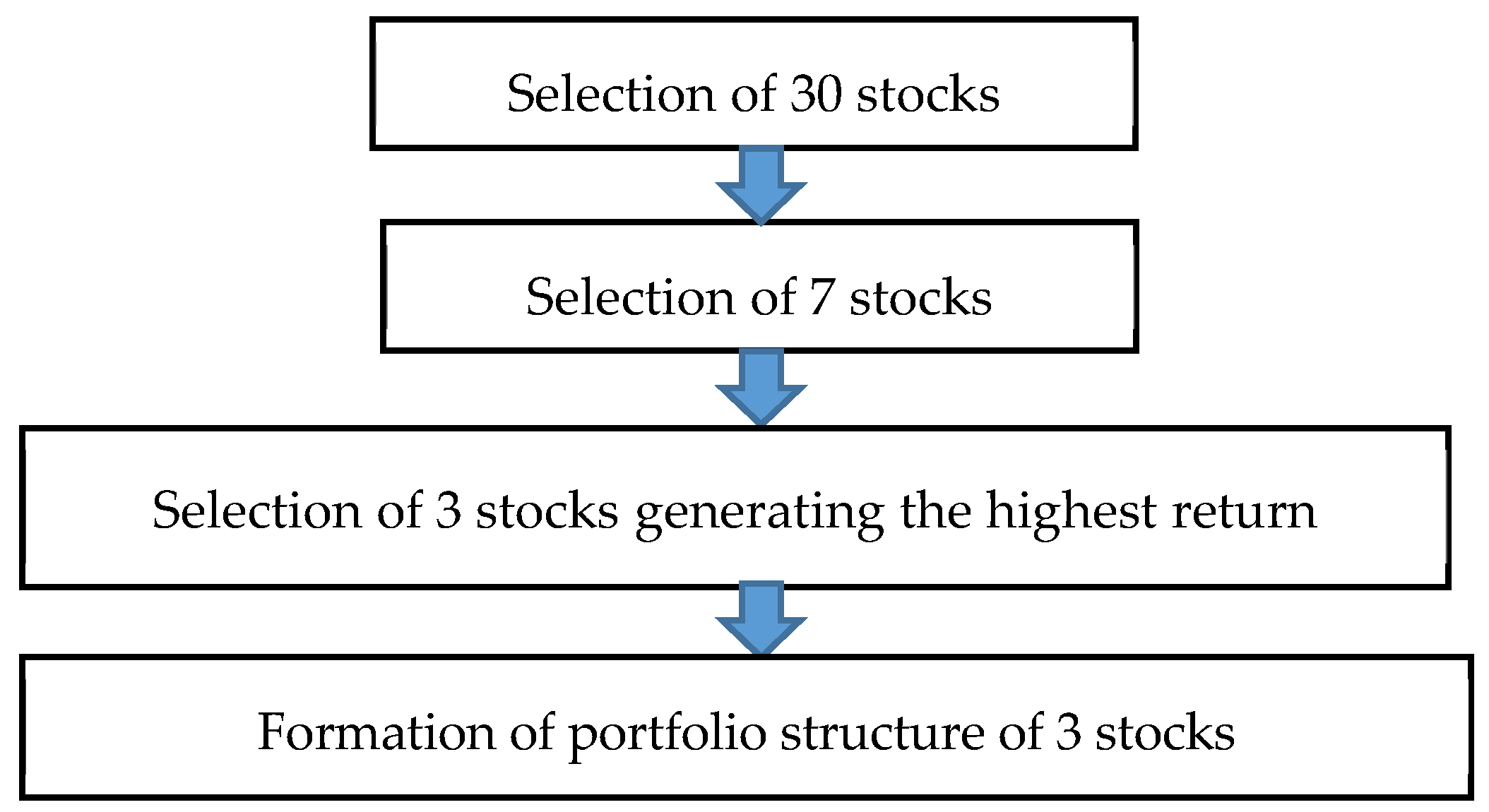

Jrfm Free Full Text Integrated Intellectual Investment Portfolio As An Efficient Instrument To Manage Personal Financial Investment Html

Non-systemic risk decreases and approaches zero.

. As the number of stocks in a portfolio is increased. However in times of distress it can increase to more than 110 stocks. This is because some stocks in the stock market usually out-perform the others while most stocks give an average return.

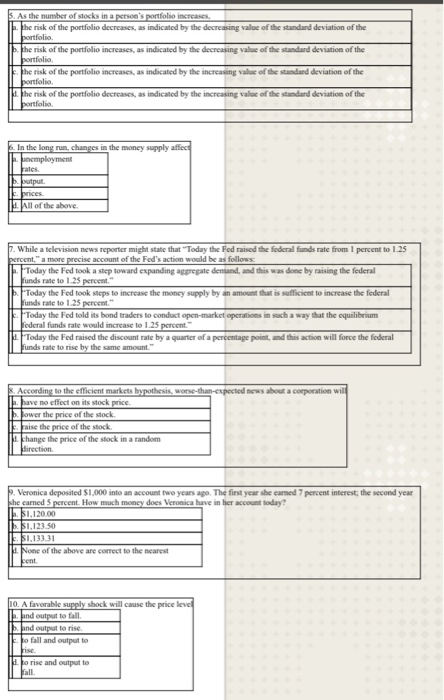

Market risk by less than an increase from 1 to 10. The market risk but not the firm-specific risk of his portfolio. The number of stocks needed to diversify risk increases during periods when markets are in financial distress.

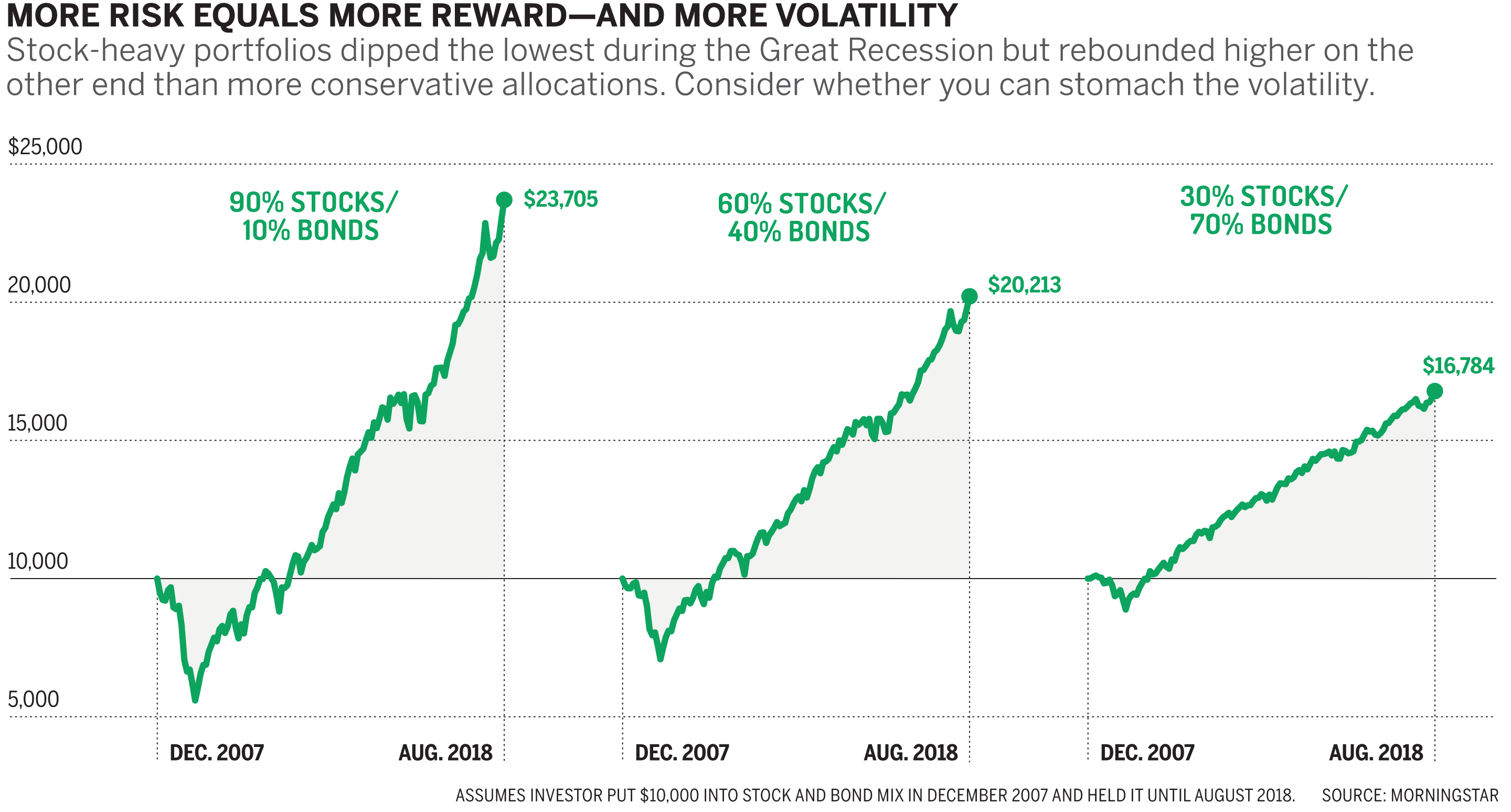

Is positively related to the average return of the portfolio. How Many Stocks and Bonds Should Be in a Portfolio. They concluded that the economic benefits of diversification are virtually exhausted when a portfolio contains ten or so stocks.

Increase the systematic risk of the portfolio B. In The Stock Market Game your team can trade a. I refer back to Peter Lynch the famed investing mutual fund manager of.

See the answer See the answer done loading. Diversifying your portfolio in the stock market is an investing best practice because it decreases non-systemic or company. As the number of assets in a portfolio increases the variance of the portfolio returns will tend towards the average standard deviation of the assets of the portfolio.

Total risk approaches zero. Increase the return of the portfolio D. Increases as the number of stocks in the portfolio increases.

Statmans study showed that the risk of the portfolio would decrease as random stocks were added. From this study came the mythical legend that 95 of the benefit of diversification is captured with a 30 stock portfolio Of course no. As the number of stocks in a portfolio rises a both firm specific risks and As the number of stocks in a portfolio rises a both School Harrisburg Area Community College.

Increase initially and then decrease d. At first the risk decreases quickly but then the rate of decrease slows substantially as shown in Figure 72. Stocks futures and commodities.

Is usually measured using a statistic called the standard diversification. The answer depends on the approach you adopt in your asset allocation. The problem of moral hazard arises because.

An increase in the number of corporations in a. However when you log into your portfolio you have more than. The average diversified portfolio holds between 20 and 30 stocks.

Stocks bonds and mutual funds. The firm-specific risk but not the market risk of his portfolio. A portfolio declines as the number of different stocks in it increases.

The minimum portfolio risk in the study was 192. As the number of stocks in your portfolio increases the overall returns on your entire portfolio usually decreases. Both the firm-specific risk and the market risk of his portfolio.

If you take an ultra-aggressive approach you could allocate 100 of your. So in a sense you can own 70 or 80 stocks but youre still heavily concentrated in your top ten or 15 ideas. Market risk by more than an increase from 1 to 10.

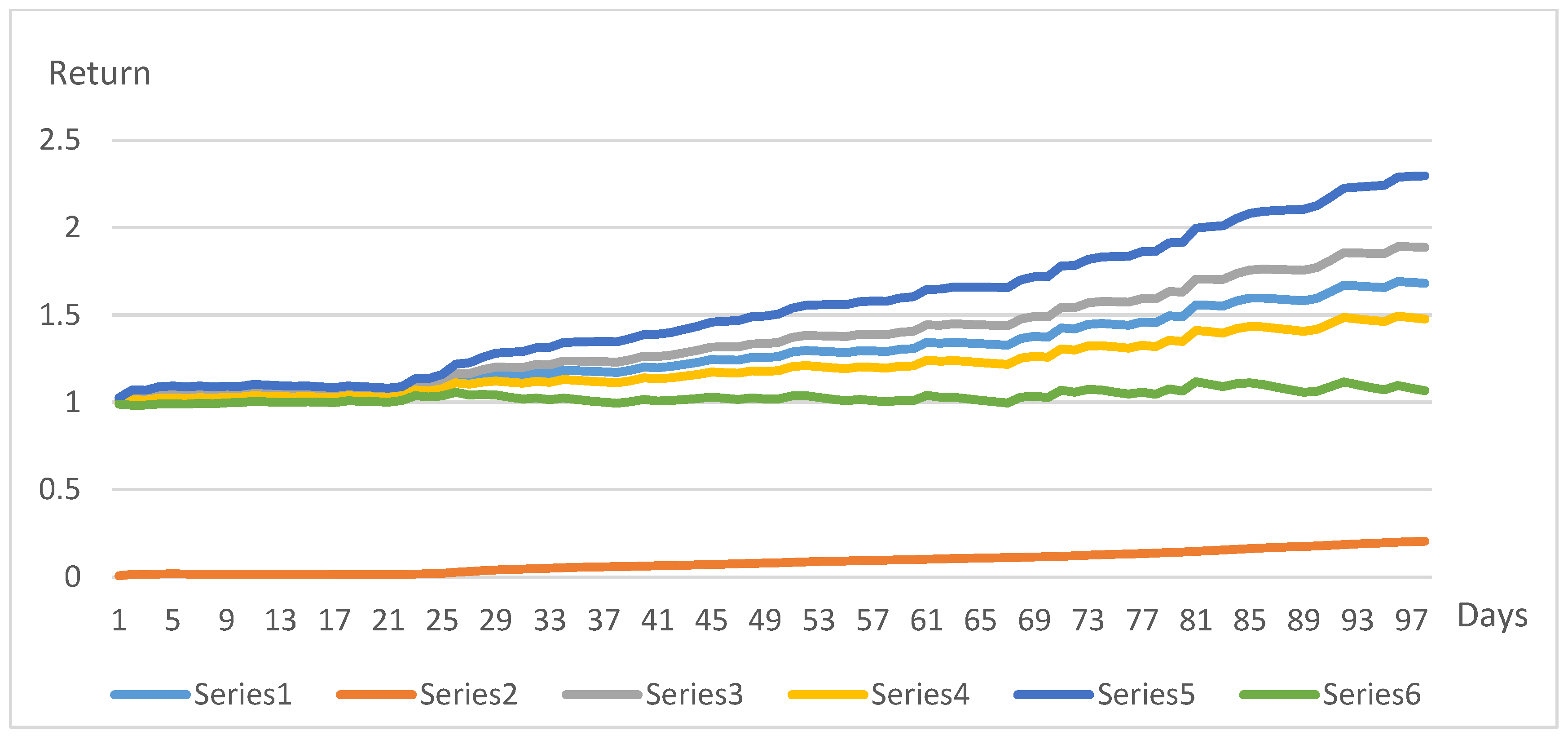

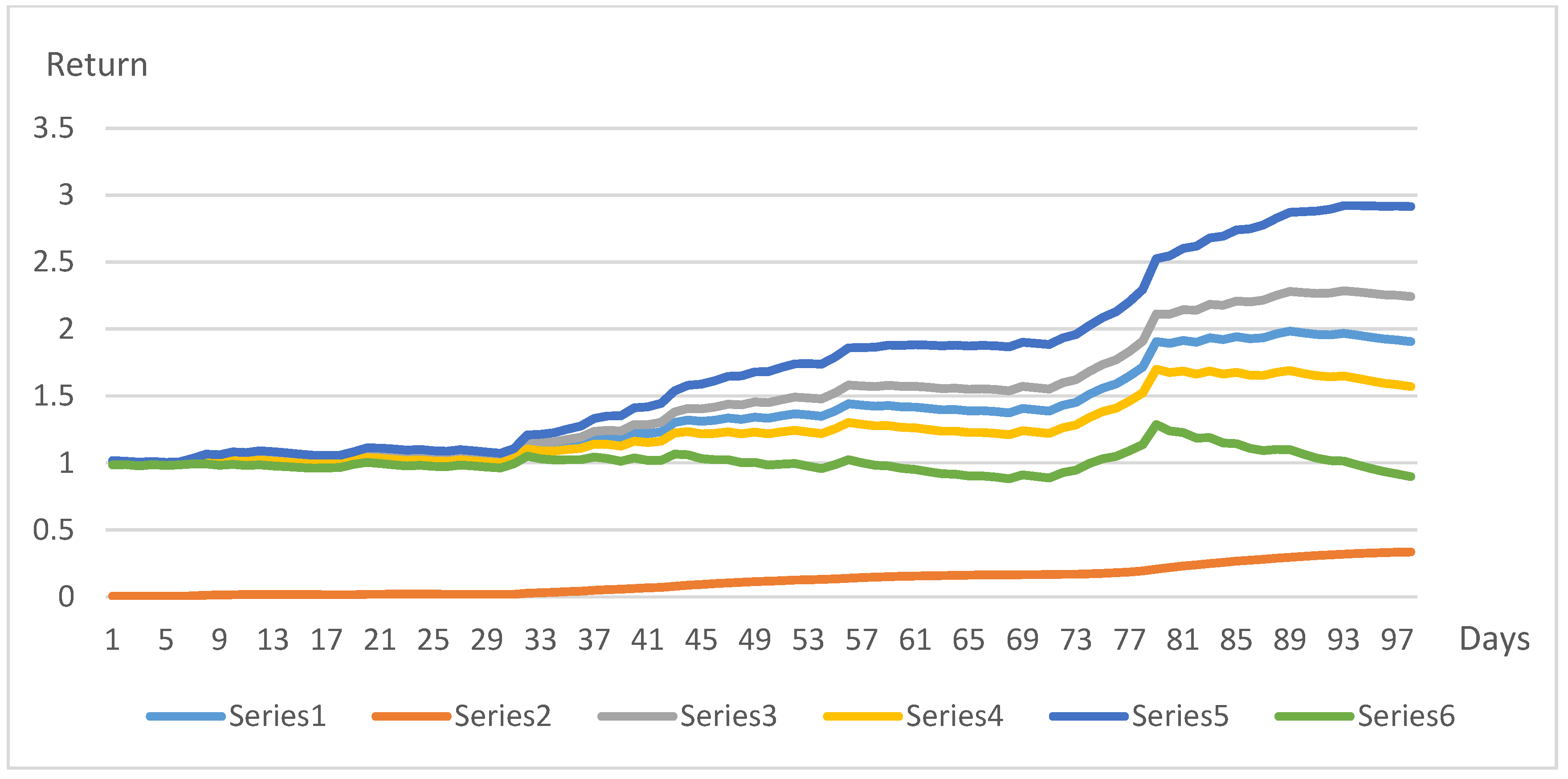

Increase the unsystematic risk of the portfolio C. As the number of stocks in a persons portfolio increases the risk of the portfolio decreases as indicated by the decreasing value of the standard deviation of the portfolio. An increase in the number of corporations in a portfolio from 110 to 120 reduces a.

Ben decided to increase the number of stocks in his portfolio. The problem of moral hazard arises because. Cannot be determined Even with assets highly correlated there will still be some though small decrease in the total.

Diversifiable risk increases and approaches zero. In doing so Ben reduced a. If you have a portfolio of 5 stocks and then add 1 more stock whose unsystematic risk is highly correlated with the current 5 the total variance of the portfolio will most likely a.

Options stocks and bonds. As the number of stocks in a persons portfolio increases the risk of the portfolio decreases as indicated by the decreasing value of the standard deviation of the portfolio. Futures options and mutual funds.

Decrease the variation in returns the investor faces in any one year. Tracking 120 stocks would be a full-time job best left to portfolio managers with a team of analysts while a handful of names isnt likely to spread your risk around to enough sectors. Bears no relationship to.

Each team in The Stock Market Game starts with 100000 cash balance. For the US even to be confident of reducing 90 percent of diversifiable risk 90 percent of the time the number of stocks needed on average is about 55. The risk of a portfolio Select one.

Decreasing the number of stocks in a portfolio from 50 to 10 would likely. The variance of each asset has units of 2 so the variance of the sum of assets does too.

/AchieveOptimalAssetAllocation-02-0e9eaa2219934b4cb85c48fb9db7b45c.png)

Determining Risk And The Risk Pyramid

This Is The Right Amount Of Stocks To Own At Every Age Money

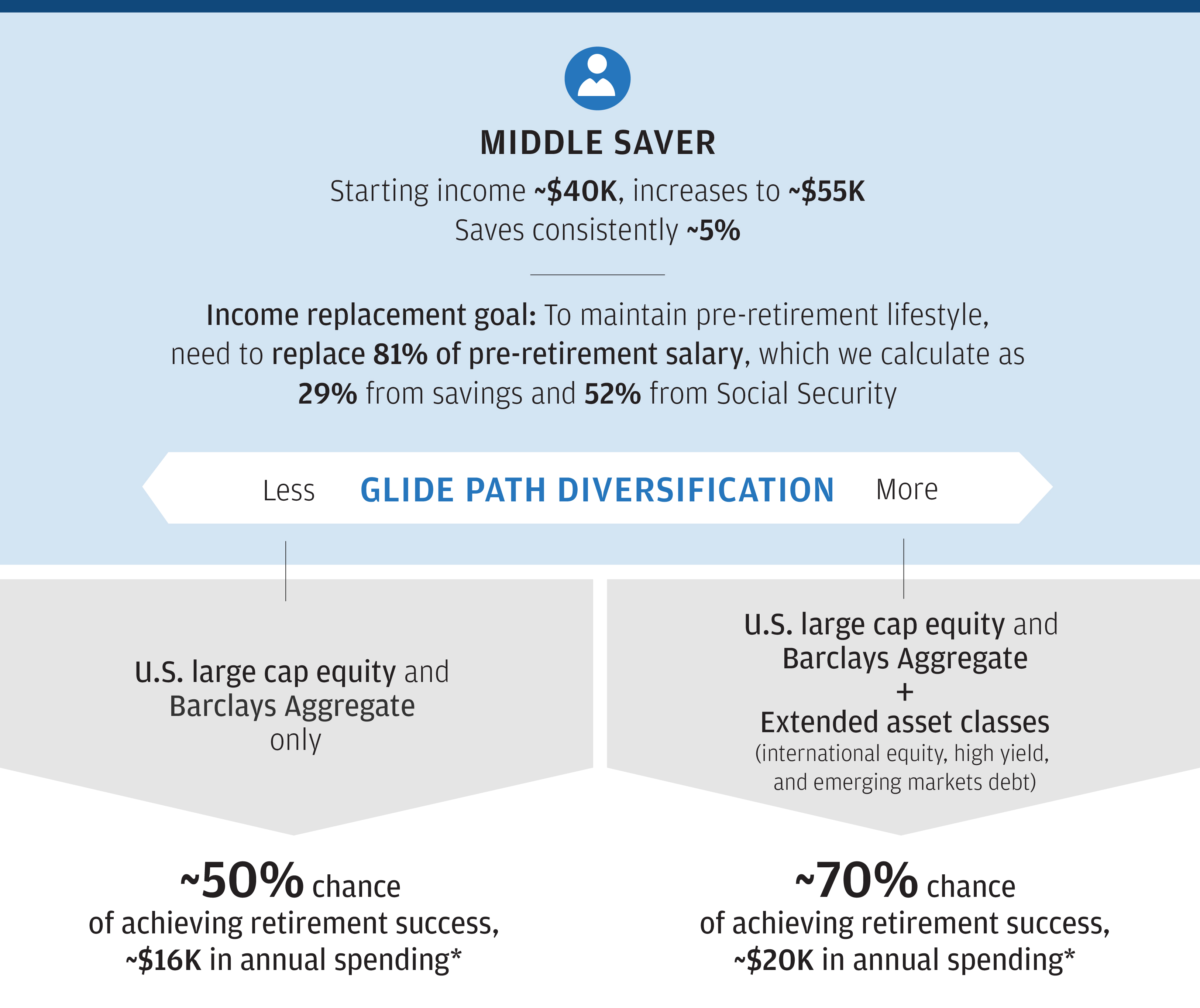

Insights To Action How Portfolio Diversification And Prudent Risk Management Can Improve Retirement Outcomes J P Morgan Asset Management

The Importance Of Diversifying Your Investment Portfolio Jasper

Jrfm Free Full Text Integrated Intellectual Investment Portfolio As An Efficient Instrument To Manage Personal Financial Investment Html

Harry Markowitz S Modern Portfolio Theory The Efficient Frontier

Pos Am 1 Globalmacro Posam Htm Pos Am As

:max_bytes(150000):strip_icc()/dotdash_Final_How_does_the_performance_of_the_stock_market_affect_individual_businesses_Nov_2020-01-acba7f0a342b4f29aa6cc0bb246d2dd3.jpg)

How Does The Performance Of The Stock Market Affect Individual Businesses

How Many Stocks Should You Own Investor S Handbook

Jrfm Free Full Text Integrated Intellectual Investment Portfolio As An Efficient Instrument To Manage Personal Financial Investment Html

Why Checking Your Stocks Everyday Is Bad

Jrfm Free Full Text Integrated Intellectual Investment Portfolio As An Efficient Instrument To Manage Personal Financial Investment Html

Solved As The Number Of Stocks In A Person S Portfolio Chegg Com

This Is The Right Amount Of Stocks To Own At Every Age Money

Behavioral Finance Understanding How Biases Impact Decisions

:max_bytes(150000):strip_icc()/conservativeportfolio-tardi-d19760c073f44c5b94bf060071963751.jpg)

/writing-hand-screen-ipad-technology-number-948715-pxhere.com-f47a4002e3c54e838830b9071d944ff7.jpg)

Comments

Post a Comment